Analysis of Trades and Trading Tips for the British Pound

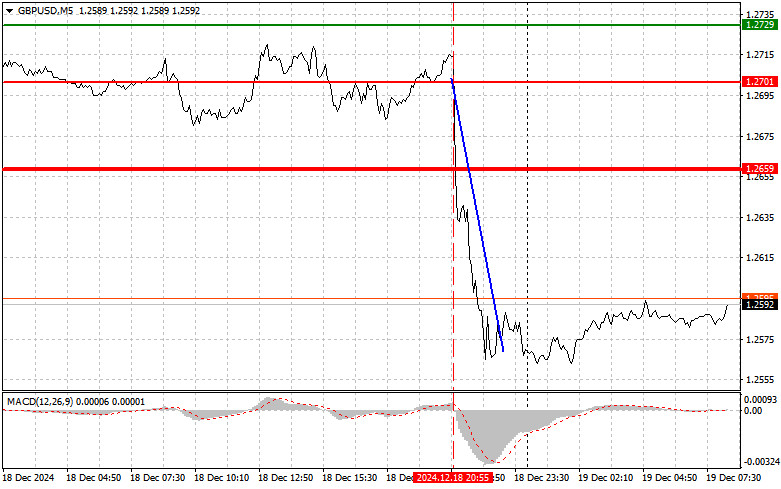

The test of the 1.2701 level occurred when the MACD indicator was beginning to move down from the zero mark, confirming the validity of a sell signal for the pound. This resulted in a decline of more than 100 pips for the pair.

The Federal Reserve's decision to lower interest rates to 4.5% led to a sharp rise in the dollar and a fall in the pound. Typically, such moves have the opposite effect, but this time was different. The expected decision from the Fed significantly impacted currency markets due to the revised forecasts for the coming years. The increased attractiveness of the dollar, as a result of maintaining a stricter monetary policy next year than previously anticipated, strengthened its position against many global currencies, including the British pound. Investors began reassessing their positions, expecting high interest rates in the U.S. to create favorable conditions for investing in American assets.

Today, the market is awaiting the Bank of England's decision on the key interest rate, with many observers anxiously anticipating the outcome. In a rapidly weakening economy, leaving rates unchanged may be interpreted as a signal of uncertainty and insufficient response to current challenges. Economic indicators show slowing growth, rising unemployment, and declining consumer demand, which threaten the economy's continued recovery. It is essential to consider that low interest rates support the economy but can also contribute to inflationary risks. If the BoE decides to keep the rate unchanged, it could erode confidence in its ability to manage instability. As a result, pressure on the pound is likely to persist regardless of the decision made by the central bank.

I will rely more on implementing Scenario #1 and Scenario #2 for today's trading strategy.

Buy Signal

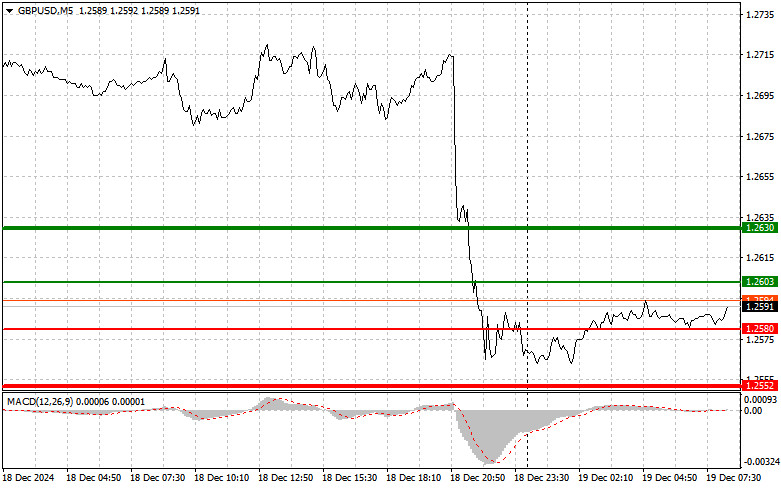

Scenario #1: Plan to buy the pound today at the 1.2603 entry point (green line on the chart) with a target of 1.2630 (a thicker green line on the chart). At the 1.2630 level, I plan to exit the buy position and open a sell position in the opposite direction (targeting a movement of 30-35 pips downward from the level). However, expecting the pound to rise today seems unlikely.

Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2580 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. A rise can be expected to the opposing levels of 1.2603 and 1.2630.

Sell Signal

Scenario #1: Plan to sell the pound today after breaking below the 1.2580 level (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.2552 level, where I plan to exit the sell position and immediately open a buy position in the opposite direction (targeting a movement of 20-25 pips upward from the level). Selling the pound would align with yesterday's trend continuation.

Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.2603 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected to the opposing levels of 1.2580 and 1.2552.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.