Analisis Dagangan Hari Isnin

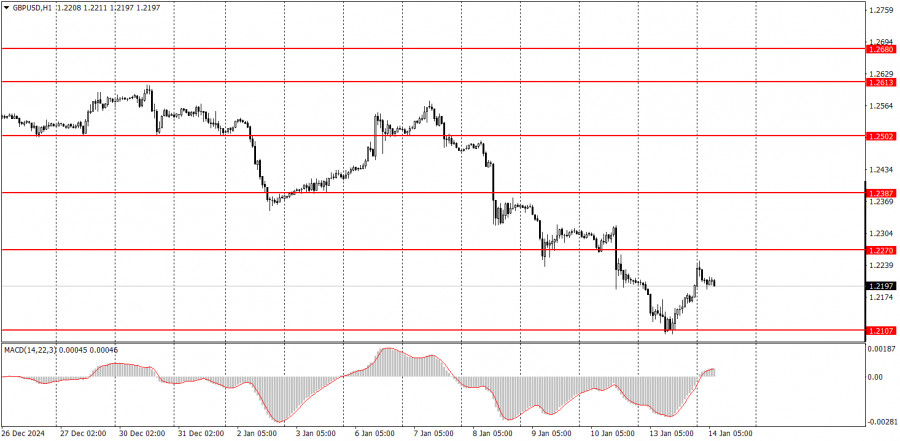

Carta H1 pasangan GBP/USD

Pasangan GBP/USD jatuh ke aras 1.2107 pada hari Isnin, di mana ia melantun semula dan memulakan pergerakan pembetulan baharu. Lantunan 100-pip ini tidak seharusnya mengelirukan; ia tidak mencukupi untuk menembusi aliran menurun semasa. Harga menemui paras rintangan yang kuat dalam laluannya, yang menyumbang kepada peningkatan kecil ini. Namun, penurunan pasangan ini mungkin akan bersambung seawal hari ini. Laporan inflasi untuk bulan Disember akan dikeluarkan di UK dan US pada hari esok dan lusa, menjadikannya acara penting minggu ini. Laporan ini boleh mencetuskan lonjakan dolar AS, mungkin menyebabkan pound sterling meneruskan aliran menurunnya. Pada hari Isnin, tiada keluaran makroekonomi yang signifikan di mana-mana negara, tetapi peserta pasaran masih aktif. Kami menjangkakan pound boleh mencapai aras sasaran yang telah kami gariskan untuk 2024: 1.1800.

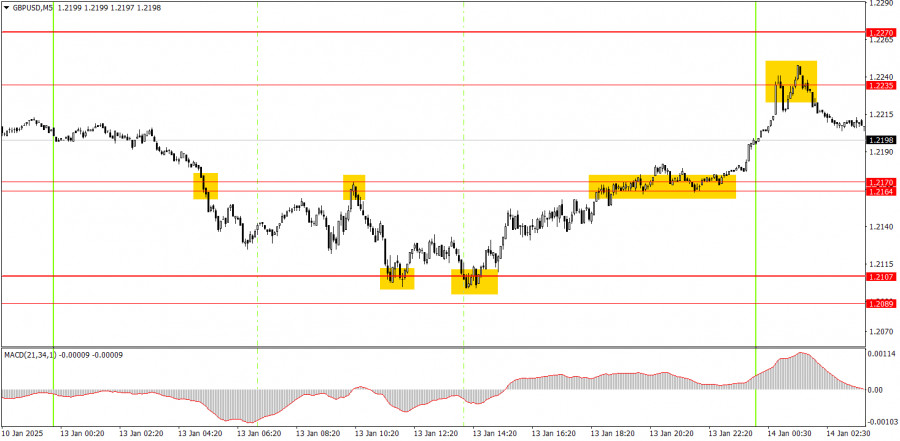

Carta M5 pasangan GBP/USD

Pada carta masa 5 minit pada hari Isnin, beberapa isyarat dagangan telah dijana. Pada waktu malam, harga telah menembusi julat 1.2164 hingga 1.2170. Semasa sesi dagangan Eropah, ia melantun semula dari paras ini dan jatuh ke 1.2107. Dalam sesi Amerika, ia sekali lagi melantun dari 1.2107 dan berjaya menembusi di atas julat 1.2164 hingga 1.2170. Pada waktu malam, ia mencapai paras tertinggi 1.2235 sebelum berundur semula.

Jelas bahawa ramai pedagang sedang tidur semasa sesi malam, yang menjadikannya sukar untuk bertindak ke atas isyarat jual terakhir. Bagaimanapun, sepanjang hari, pedagang baru boleh membuka kedudukan pendek diikuti dengan kedudukan panjang, dengan semua dagangan ini menghasilkan keuntungan yang baik.

Strategi Dagangan untuk Selasa:

Pada carta masa setiap jam, pasangan GBP/USD terus membentuk aliran penurunan, dengan pound menurun hampir setiap hari. Dalam jangka masa sederhana, kami percaya dengan teguh bahawa penurunan lanjut ke arah paras 1.1800 adalah senario yang paling logik. Oleh demikian, kita harus menjangkakan pergerakan ke bawah tambahan, tetapi seperti biasa, keputusan dagangan harus berdasarkan isyarat teknikal.

Pada hari Selasa, pasangan GBP/USD mungkin memulakan penurunan baharu selepas melantun dari paras 1.2235.

Untuk dagangan intrahari pada carta masa 5 minit, perhatian boleh difokuskan pada tahap-tahap berikut: 1.2010, 1.2052, 1.2089-1.2107, 1.2164-1.2170, 1.2235, 1.2270, 1.2316, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2723, dan 1.2791-1.2798. Tiada acara utama atau laporan dijadualkan di UK pada hari Selasa. Di AS, Indeks Harga Pengeluar akan dikeluarkan, walaupun ia tidak mungkin memberi impak besar kepada kadar pertukaran dolar.

Peraturan Sistem Dagangan Teras:

- Kekuatan Isyarat: Semakin singkat masa yang diperlukan untuk sesuatu isyarat terbentuk (lantunan atau penembusan), semakin kuat isyarat tersebut.

- Isyarat Palsu: Jika dua atau lebih dagangan berhampiran sesuatu paras menghasilkan isyarat palsu, semua isyarat berikutnya dari paras tersebut perlu diabaikan.

- Pasaran Mendatar: Dalam keadaan pasaran mendatar, pasangan mata wang boleh menghasilkan banyak isyarat palsu atau tiada langsung. Sebaiknya hentikan dagangan sebaik sahaja tanda-tanda pasaran mendatar muncul.

- Waktu Dagangan: Buka dagangan antara permulaan sesi Eropah hingga pertengahan sesi AS, dan tutup semua dagangan secara manual selepas itu.

- Isyarat MACD: Pada rangka masa setiap jam, dagangkan isyarat MACD hanya semasa terdapat volatiliti yang mencukupi dan trend yang jelas disahkan oleh garisan aliran atau saluran aliran.

- Paras Berdekatan: Jika dua paras terlalu rapat (5–20 pip), anggap ia sebagai zon sokongan atau rintangan.

- Henti Rugi (SL): Tetapkan SL pada titik pulang modal selepas harga bergerak 20 pip ke arah yang diingini.

Elemen Carta Utama:

Tahap Sokongan dan Rintangan: Ini adalah paras sasaran untuk membuka atau menutup kedudukan dan juga boleh berfungsi sebagai titik untuk meletakkan pesanan Ambil Untung (TP).

Garisan Merah: Saluran atau garisan aliran yang menunjukkan aliran semasa dan arah pilihan untuk berdagang.

Penunjuk MACD (14,22,3): Histogram dan garisan isyarat digunakan sebagai sumber tambahan isyarat dagangan.

Acara dan Laporan Penting: Ditemui dalam kalendar ekonomi, ini boleh mempengaruhi pergerakan harga dengan ketara. Berhati-hati atau keluar dari pasaran semasa penerbitannya untuk mengelakkan pembalikan tajam.

Pedagang baharu forex perlu memahami dengan lebih jelas bahawa tidak setiap dagangan akan menguntungkan. Membangunkan strategi yang jelas dan mengamalkan pengurusan wang yang betul adalah penting untuk kejayaan dagangan jangka panjang.